TAKING ACTION: INSTITUTIONAL INVESTORS PROGRESS ON THE PATH TO SUSTAINABILITY

Building on its three previous editions, BNP Paribas’ ESG Global Survey 2023 examines institutional investors’ progress on the path to sustainability. We have chosen to focus on how they are practically implementing their ESG strategies and the obstacles they are encountering along the way.

Our results are shared in three reports, focusing on ESG data and reporting, sustainable investing trends and the operating model required to support institutional investors on their sustainability journey.

We hope you find these reports an interesting and thought-provoking read.

Sophie Devillers

Head of Sustainable Finance, Securities Services, BNP Paribas

Delphine Queniart

Head of Sustainable Finance Client Engagement, BNP Paribas Global Markets

Data & Reporting

Find out more

Sustainable investing trends

Find out more

Integration of ESG expertise in operations

Find out more

ESG data is now more crucial than ever. In this paper, we address the key challenges investors face with ESG data and explore the solutions.

In this report, we explore how investors are aligning their investments with net zero and other ESG objectives.

We examine how institutional investors are integrating ESG expertise and data into their portfolio management and investment decisions.

TAKING ACTION: INSTITUTIONAL INVESTORS PROGRESS ON

THE PATH TO SUSTAINABILITY

Building on its three previous editions, BNP Paribas’ ESG Global Survey 2023 examines institutional investors’ progress on the path to sustainability. We have chosen to focus on how they are practically implementing their ESG strategies and the obstacles they are encountering along the way.

Our results are shared in three reports, focusing on ESG data and reporting, sustainable investing trends and the operating model required to support institutional investors on their sustainability journey.

We hope you find these reports an interesting and thought-provoking read.

Data & Reporting

Find out more

ESG data is now more crucial than ever. In this paper, we address the key challenges investors face with ESG data and explore the solutions.

Sustainable investing trends

Find out more

In this report, we explore how investors are aligning their investments with net zero and other ESG objectives.

Integration of ESG expertise in operations

Find out more

We examine how institutional investors are integrating ESG expertise and data into their portfolio management and investment decisions.

Survey Summary

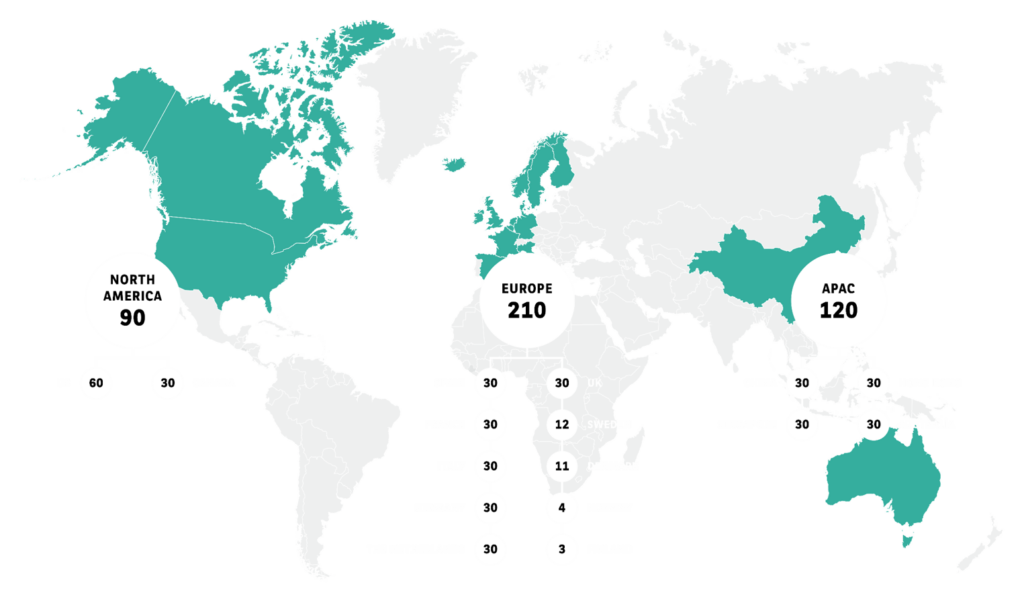

The ESG Global Survey 2023 was commissioned to gather the views of asset owners, asset managers, hedge funds, and private capital firms on certain ESG topics. CoreData Research administered an extensive online survey that includes a sample of 180 asset owners 180 asset managers, and 60 hedge funds & private capital firms. The data was collected from 15 countries throughout Europe (50%), Asia Pacific (28.6%) and North America (21.4%). This is a summary of the study’s results.

Key findings of BNP Paribas’s ESG Global Survey 2023 include:

- Commitment towards net zero is accelerating: 41% of respondents say it is a priority for their organisation now, and that figure will grow to 48% within the next 2 years.

- Impact investing is increasing in importance: 54% expect to use it in the next two years (vs. 45% now). Impact investing is set to become the most popular ESG approach globally.

- Active ownership will play a key role: 45% say it will be a key ESG objective within the next 2 years.

- Regulation and reputational risks are major drivers. Respondents say their organisation is primarily assessing the financial materiality: regulation risks at 60%, reputational risks at 58%

- Data quality remains the biggest barrier to ESG investing: 71% see inconsistent and incomplete ESG data as a significant barrier to the greater adoption of ESG

- ESG expertise integrated into investment-related operations: 51% say their organisation is integrating ESG expertise and data into portfolio management / investment decisions.

Executive summary

1/ Sustainable investing to focus on positive impacts

Impact investing is increasing in importance: we see an increase in the future in the use of impact investing, as investors seek to make a measurable, positive impact with their investments. It is becoming more important as a key ESG objective and as a method of ESG investing and is one of the top two elements in defining a sustainable investment.

Active ownership a key ESG objective with multiple targets Currently, active ownership is a key ESG objective for investors. But over the next few years, its key engagement goals will broaden from climate change and decarbonisation, the priority for many now, to a wider mix of environmental, social and governance topics.

Private market assets increasingly incorporate ESG criteria Private equity and private debt, along with equities and fixed income, are now the asset classes most likely to have ESG criteria incorporated into investments. This ties into the growing importance of impact investing, as investors may have more scope to have a positive impact through private market investments than in other asset classes.

Giving asset managers carbon reduction targets is on the up We find that in two years’ time, over 80% of investors will have imposed carbon reduction targets on their external asset managers. At present, investors do this through soft targets, as opposed to hard targets, by a ratio of 4 to 1.

2/ ESG data and reporting and its challenges

ESG data remains an obstacle for investors: investors see inconsistent and incomplete data as a key barrier to greater adoption of ESG investing, along with its cost and poor quality. To get around this, investors use multiple data sources and ensure the transparency of raw data among other methods.

Generalists and specialists are used for ESG data Many investors use both generalist and specialist ESG data vendors, with the latter widely used in relation to UN Sustainable Development Goals (SDGs), the most popular external framework for sustainable investing, while a mix of data vendors is most often used for alternatives.

ESG reporting is often integrated into financial reporting We find that the most popular method of reporting ESG data is to integrate it into existing financial reporting, with over a third of investors doing so. The next most widely used formats and approaches are to present raw ESG data, then dynamic data visualisation and static reports.

3/ Operating models: investors on banking partners

Areas where investors would pick a banking partner: we find that structured ESG products is the area where investors are most likely to use a banking partner or provider, followed by facilitating access to raw ESG data. Independent monitoring of ESG guidelines, data management services and portfolio risk management are also areas where investors may use a banking partner or provider.

Criteria for selecting a banking partner or provider: nearly half of investors say that the transparency of data methodology is the most important criteria for selecting a banking partner or provider, followed by brand reputation on ESG and providing leading ESG skills and expertise.

Integrating ESG expertise into investment-related operations: investors are most likely to have integrated ESG expertise and data into portfolio management and investment decisions, followed by risk management and monitoring. And over a third have integrated ESG expertise and data into monitoring ESG rule compliance, strategic asset allocation and asset and investment selection.

Institutional investors are using their influence to move capital towards investments that will deliver measurable impacts alongside financial returns. One such approach is the integration of Environmental, Social and Governance factors.

We surveyed 420 institutional investors across Europe, North America & Asia Pacific representing more than EUR 46 trillion assets under management and compared the results against our 2021 survey.

- Commitment towards net zero is accelerating. 41% this year say it is a priority for them now and that figure will grow to 48% within the next 2 years.

- Active ownership will play a key role in this, with 45% saying it will be a key ESG objective now and in the next 2 years.

- 76% seeing climate change and decarbonisation as a priority now for voting, engagement and possible investment changes.

- 44% of respondents are underweighting carbon-intensive sectors or restricting to best ESG performers as the most common step in achieving portfolio decarbonisation. 43% are also excluding carbon-intensive sectors.

- Organisations are still dealing with struggles with ESG data, with the following being identified as the three biggest obstacles:

- Poor quality analytics for ESG data

- Cost of ESG data

- Inconsistency between different ESG vendors on same themes

- In order to integrate climate change risk into valuations, 65% are using their own methodology for asset selection.

- On a global level, organisations have assessed the financial materiality of these issues the most:

- Regulation risk – 60%

- Reputation risk – 58%

- Governance factor – 51%

About this research

The ESG Global Survey 2023 (4th edition) examines how institutional investors are keeping up with increasing ESG expectations, adapting to a changing landscape, and handling data. CoreData Research conducted the survey for BNP Paribas, gathering responses from 420 institutional investors worldwide, managing over USD 51 trillion in assets.

The sample included 180 asset owners, 180 asset managers, and 60 hedge funds and private capital firms from 15 countries across Europe (50%), Asia Pacific (28.6%), and North America (21.4%).

The quantitative survey was conducted online and complemented by in-depth interviews for qualitative insights.

Fieldwork was conducted from April to July 2023.

Contacts to know more about 2023 ESG Survey

Sophie Devillers

Head of Sustainable Finance

Securities Services BNP Paribas

Laura Vitagliano

Head of Sustainable Finance Strategy Client Engagement

Securities Services BNP Paribas

Delphine Queniart

Head of Sustainable Finance Client Engagement,

BNP Paribas Global Markets

Trevor Allen

Head of Sustainability Research, Global Markets

Previous ESG Surveys

The path to ESG. No turning back for asset owners and managers

Asset owners and managers determine their ESG integration strategies

Great expectations for ESG

x

Access the ESG Survey 2023

To request your access to the ESG Survey 2023, please complete the form below

Personal data collected above are subject to a treatment designed especially for the internal management and, where appropriate, for the purposes of commercial prospecting by BNP Paribas and / or its sub-contractors. Your personal data will be kept for the duration of the contractual relationship with us plus a specified number of years after the end of the contractual relationship or as otherwise required by applicable law.

For the same purposes as mentioned above, BNP Paribas may also transfer personal data to its subsidiaries and/or affiliates, as well as external service providers located outside of the EEA.

In accordance with the General Data Protection Regulation (GDPR), European Regulation no. 2016-679, depending on the nature of the processing of the personal data concerned, you have a right of access, rectification and erasure of your personal data together with the right to restrict or object to the processing of such data. For more information on the General Data Protection Regulation (GDPR), details regarding processing purposes, and data retention principles, as well as your rights in relation to the processing of your personal data by BNP Paribas SA, in the context of Securities Services activities, please refer to our data protection notice: https://cib.bnpparibas/data-protection-notice/.